Table of Contents

Toggle- Introduction

- Components of Packaging Pricing

- Packaging pricing – fixed cost

- Packaging Pricing – Fixed Costs

- Packaging pricing – variable cost

- Tariff Costs

- Packaging Cost Breakdown Chart

- Next Steps: Get Started on Your Packaging Process

- Partnering with the Packaging Supplier Who Treats You as a Business Partner

- FAQs: Packaging Pricing

Introduction

When it comes to packaging, most businesses spend 10–40% of their product’s retail price on packaging. While product quality is essential, it’s important to remember that packaging is the first impression your customers will have of your brand.

A strategically designed package not only protects your product but also enhances your brand story, attracts customers, and influences purchasing decisions.

If you’re trying to figure out branding, design, and budgeting—this guide will help. We’ll break down the true cost of packaging pricing so you can make informed decisions for your business.

Components of Packaging Pricing

Packaging isn’t just about the box—it’s a combination of multiple factors that influence total cost:

- Design – Brand logos, colors, and structural design.

- Prototypes – Samples before large-scale production.

- Materials – Paper, plastic, metal, or sustainable options.

- Production – Printing, cutting, and assembly.

- Labor – Workforce involved in manufacturing.

- Shipping + Tariff (import) – Import/export-related expenses.

Together, these elements make up the total packaging cost. To better understand, let’s break them into fixed and variable costs.

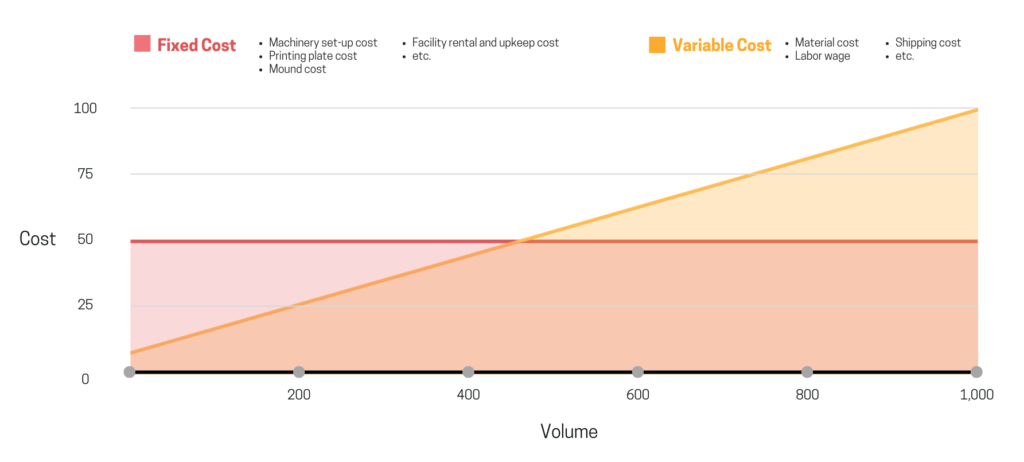

Packaging pricing – fixed cost

Packaging Pricing – Fixed Costs

Fixed costs are expenses that remain constant regardless of the number of units produced. These include:

- Machinery setup costs

- Printing plate costs

- Mould/tooling fees

- Facility rental and upkeep

📌 The higher your order volume, the lower your per-unit fixed costs will be. (ratio of fixed costs)

Packaging pricing – variable cost

Variable costs change based on production output. The most common examples are:

- Raw material costs

- Labor wages

- Energy and utilities during production

- Shipping and logistics

For instance, producing 100 units requires more material than producing 10 units, which means total costs rise with higher output. However, the cost per unit decreases with scale.

Tariff Costs

Tariffs are government-imposed taxes on imported materials. They have a major impact on packaging costs, especially for companies importing from abroad.

- In 2025, the U.S. introduced a 25% tariff on imported packaging materials.

- Tariffs on Chinese goods reached a staggering 55%, driving businesses to rethink supply chains.

How companies respond:

- Absorb costs – Maintain pricing but reduce margins.

- Raise prices – Pass expenses onto customers.

- Restructure supply chains – Source from tariff-friendly regions (e.g., Vietnam).

✅ Tip: Stay informed with the U.S. International Trade Commission Tariff Database to track duty rates for packaging materials.

Related Articles:

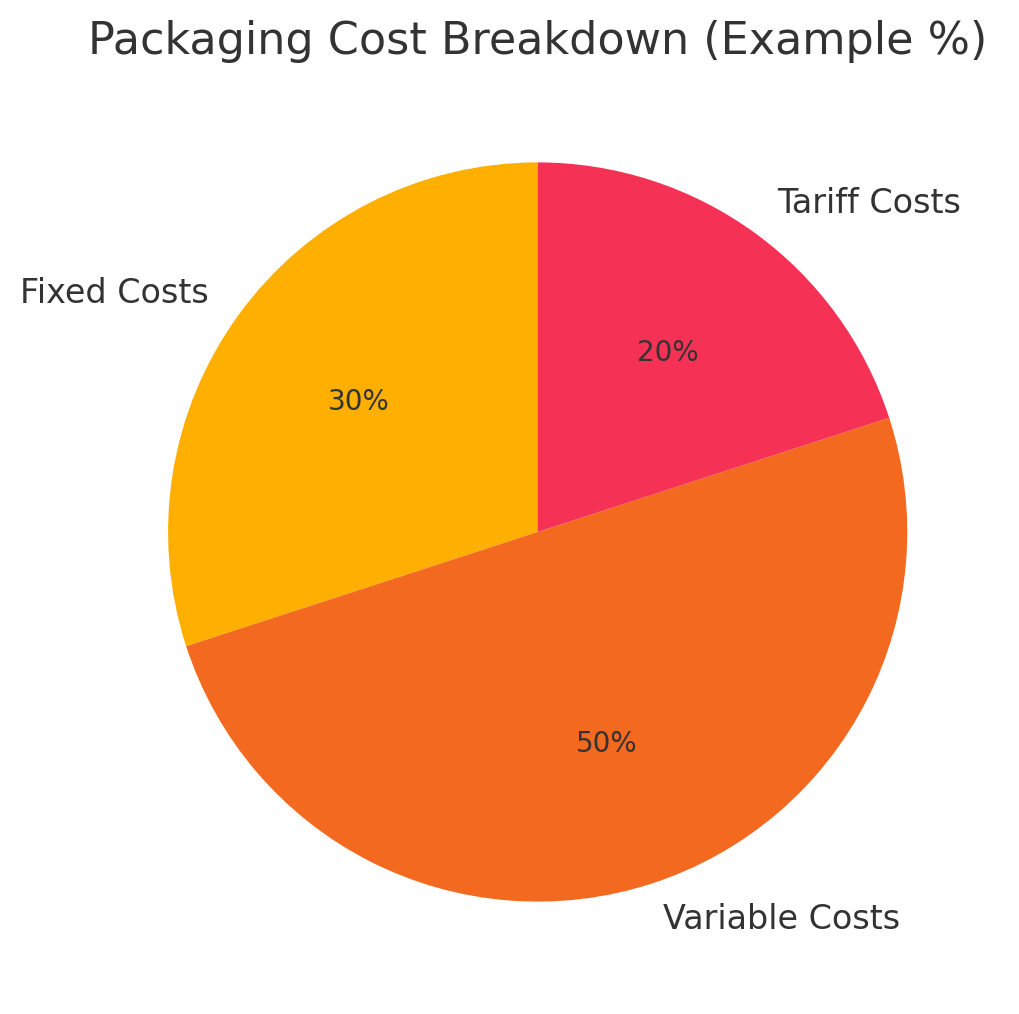

Packaging Cost Breakdown Chart

Below is a visual example of how packaging costs may be distributed between fixed costs, variable costs, and tariffs:

Next Steps: Get Started on Your Packaging Process

Here’s how to move forward:

- Work with a one-stop supplier – Streamline processes and reduce risks.

- Define your packaging budget – Align it with your product retail price.

- Set priorities – Sustainability, cost-efficiency, or luxury appeal.

Partnering with the Packaging Supplier Who Treats You as a Business Partner

At INNORHINO, we believe packaging isn’t just about protection—it’s about building a memorable customer experience.

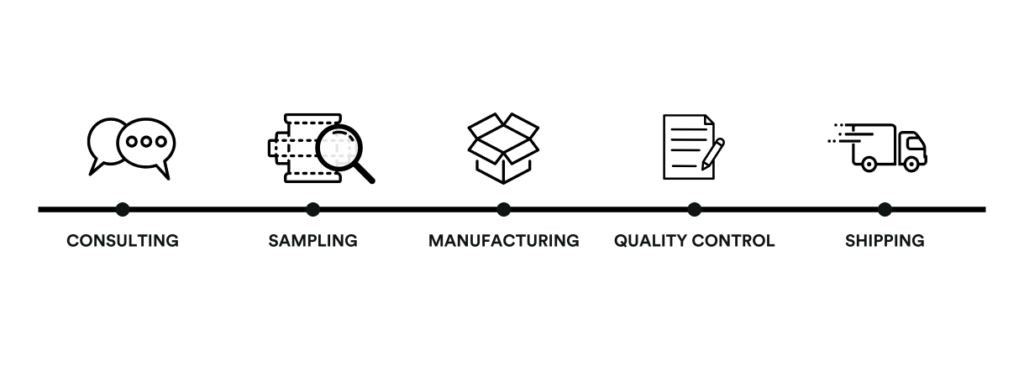

From design to production, we specialize in custom packaging solutions that align with your brand values and market goals.

👉 Ready to optimize your packaging strategy? Contact INNORHINO today to start your project!

FAQs: Packaging Pricing

Typically, 10–40% of the retail price.

Yes, eco-friendly materials may cost more but deliver long-term brand benefits.

Bulk ordering, material optimization, and supplier partnerships.

They increase costs significantly—sometimes by 25% or more.

Fixed = constant expenses. Variable = change with production volume.